Explore High-Growth Alternative Investment Products

Unlock a free webinar revealing how Pre-IPO Shares, Litigation Funding, Livestock Investments & Gold Bonds can elevate your portfolio.

Expert-Led Opportunities

Access carefully curated investment options

High-Yield Potential

Assets with returns from 15% p.a.

International Reach

Global structured investment access

Strategic Guidance

Personalized options tailored to you

Inside the Webinar: Discover Smarter Ways to Build Wealth

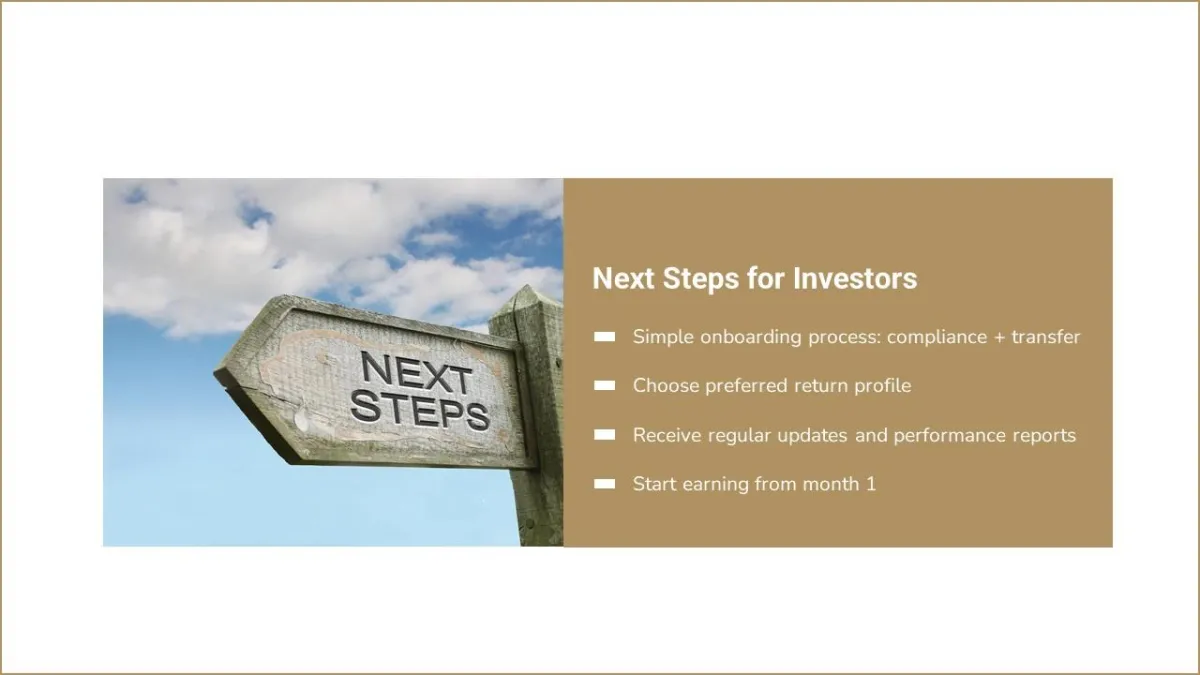

Understand how alternative assets like litigation funding and pre-IPO equity can outperform traditional markets.

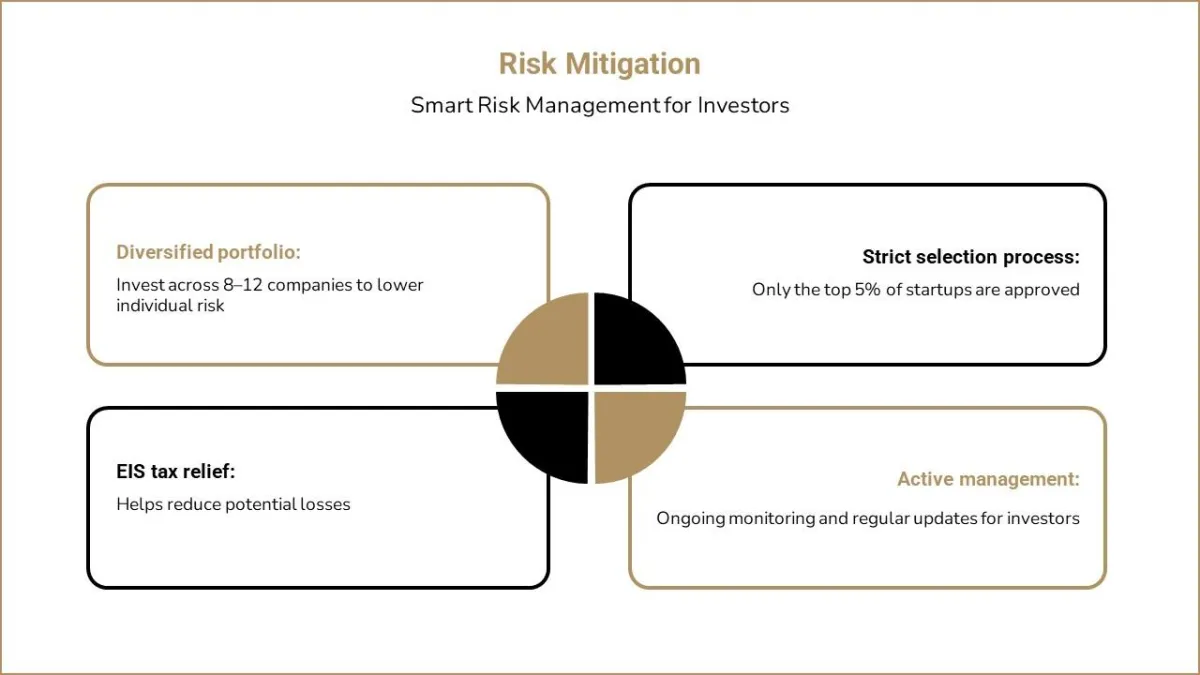

Learn how to balance risk and maximize tax-efficient returns.

See how actual investors achieved success through Ultra Investment.

Invest in Justice. Earn from Outcomes.

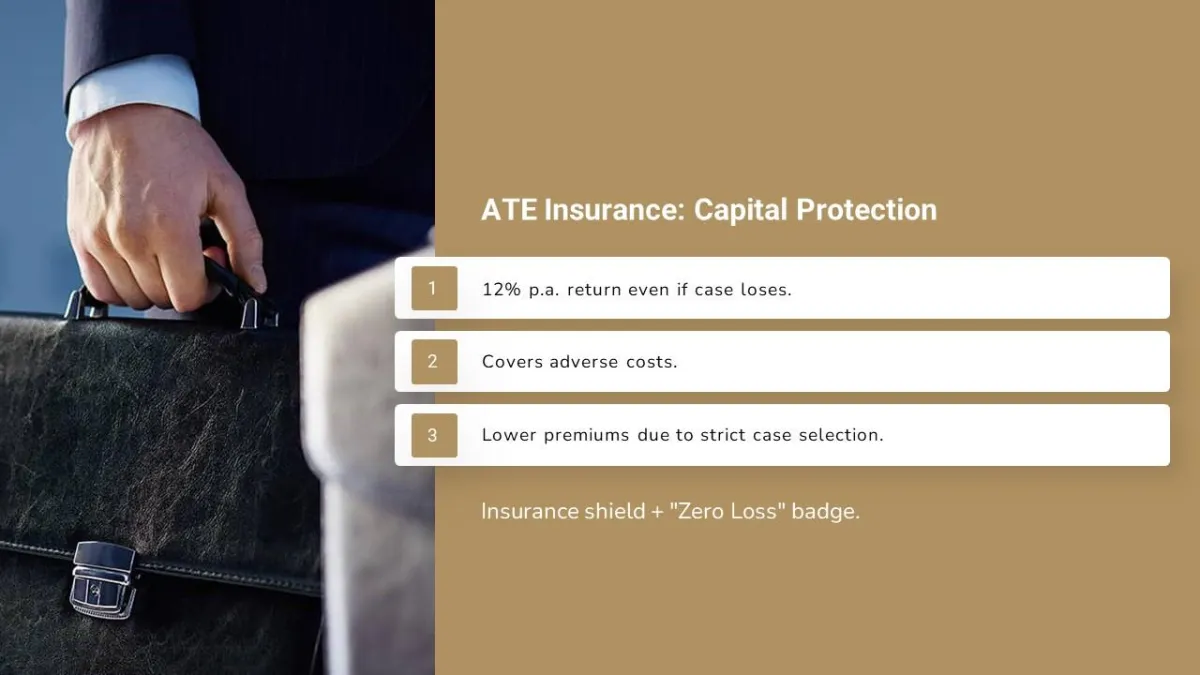

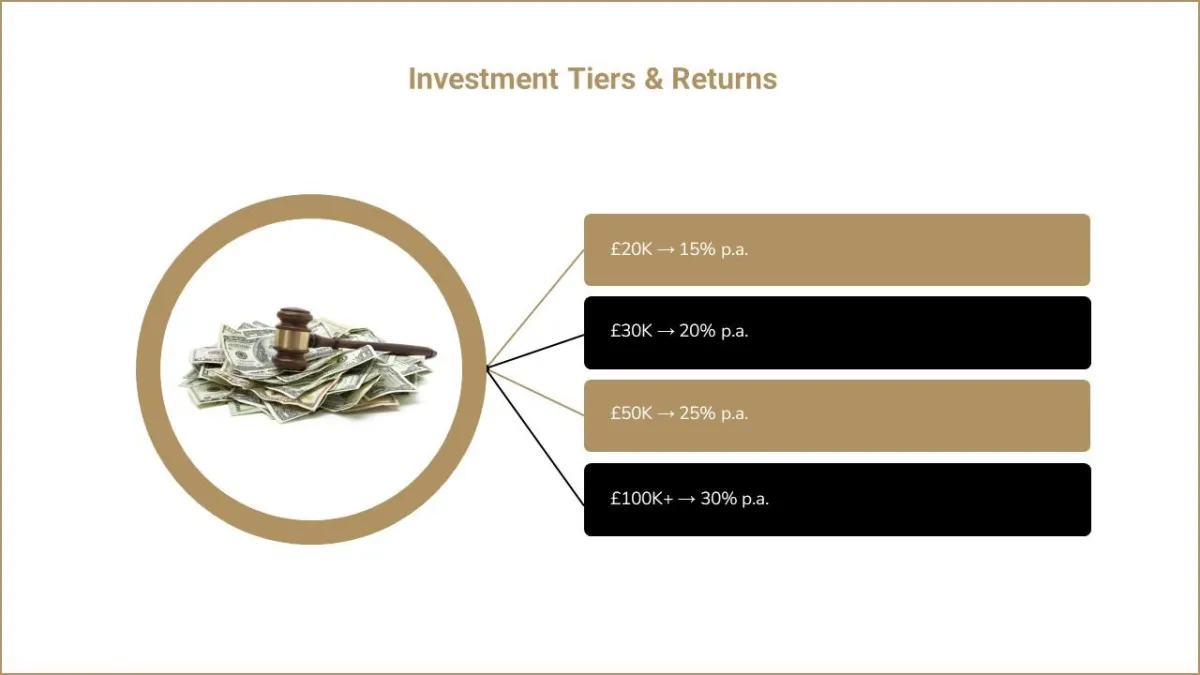

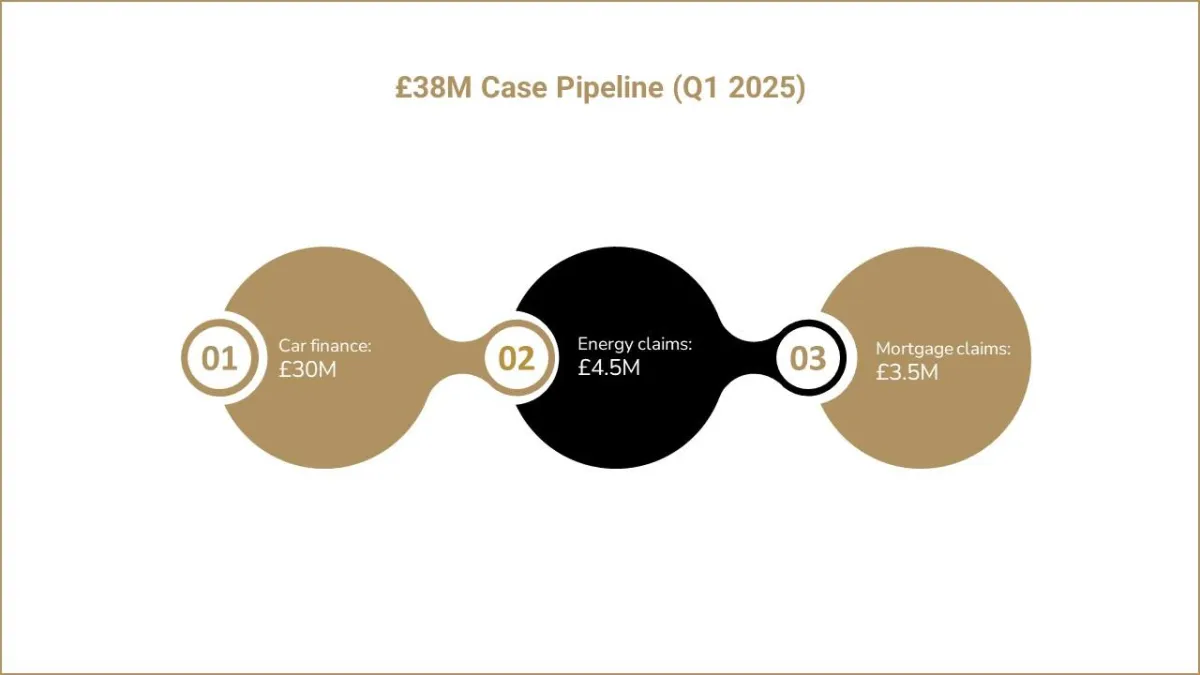

Litigation funding enables investors to tap into legal case settlements by financing claims in return for a share of the proceeds. This asset class operates independently of traditional financial markets, offering a unique diversification route. Returns range from 15% to 30% per annum, depending on the structure and case duration. Ideal for forward-thinking investors seeking uncorrelated high-yield alternatives.

15–30% Annual ROI

Depending on case portfolio and duration, litigation funding can offer returns from 15% up to 30% annually.

Non-Correlated Asset

Protect your portfolio from stock market swings with an investment tied to legal outcomes, not market prices.

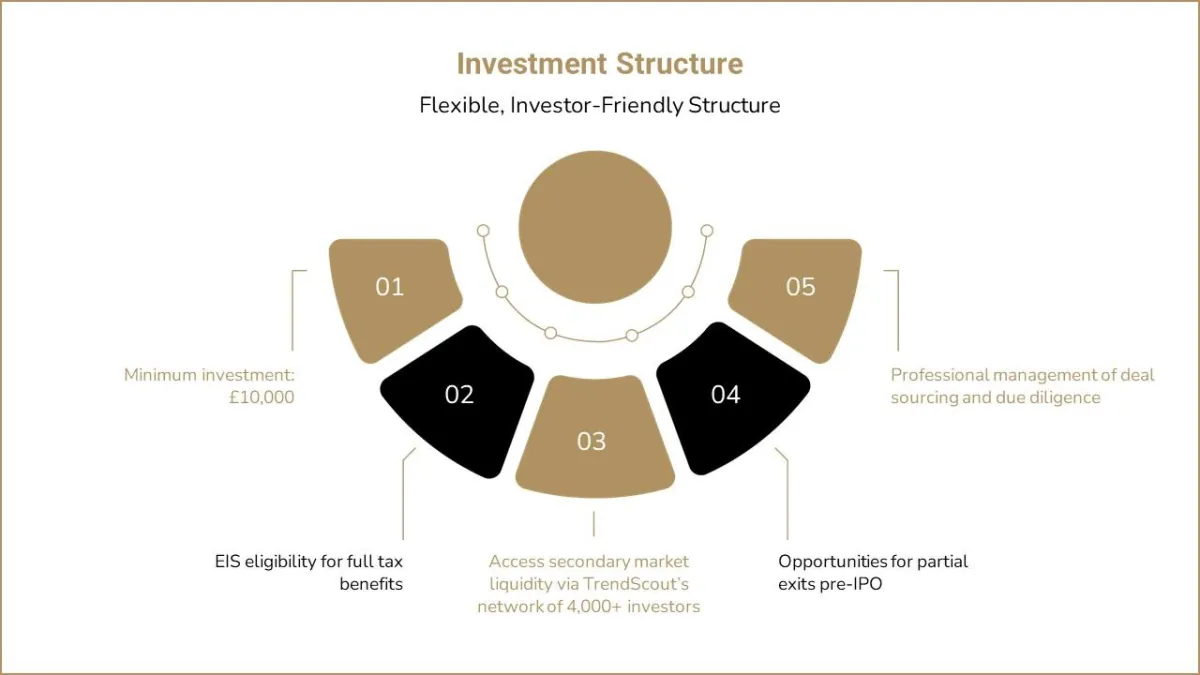

Pre-IPO Equity Opportunities with Tax Incentives

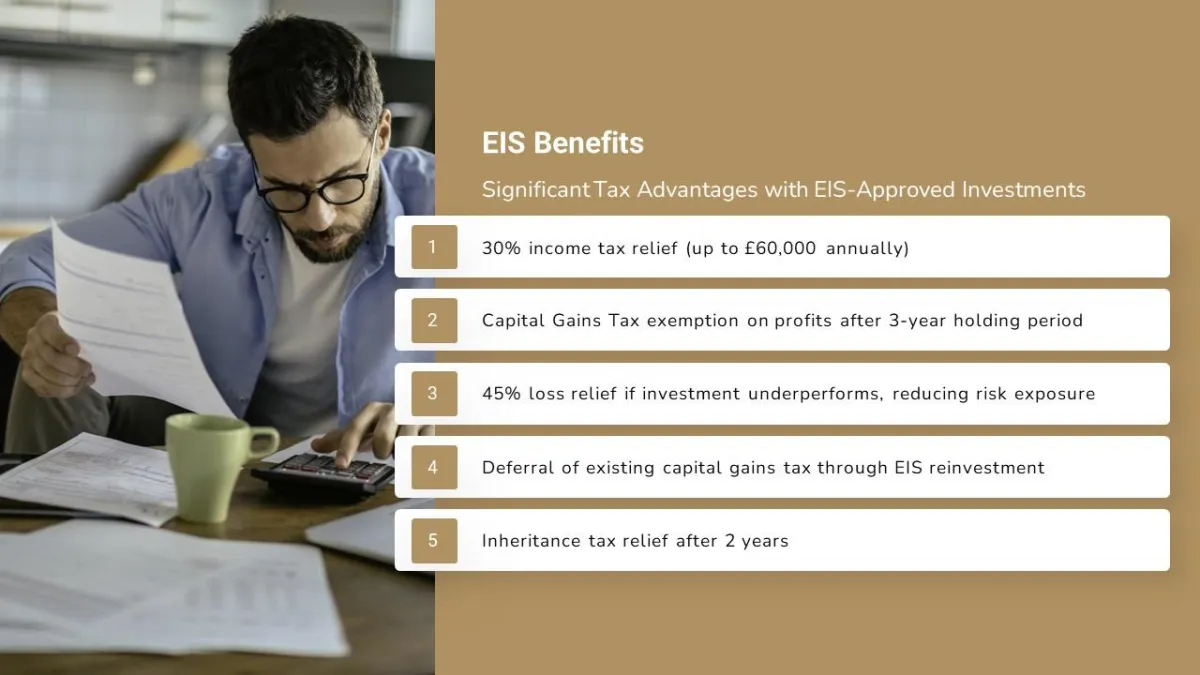

Invest before the market does. Our Pre-IPO equity offerings provide access to shares in high-growth companies ahead of their public debut — a unique window where upside potential is significantly greater. With government-backed incentives like the HMRC’s Enterprise Investment Scheme (EIS), investors can enjoy tax-efficient growth while diversifying into early-stage innovation.

HMRC EIS Approved

Backed by the UK Government’s Enterprise Investment Scheme, these offers provide tax-efficient investing in vetted high-growth companies.

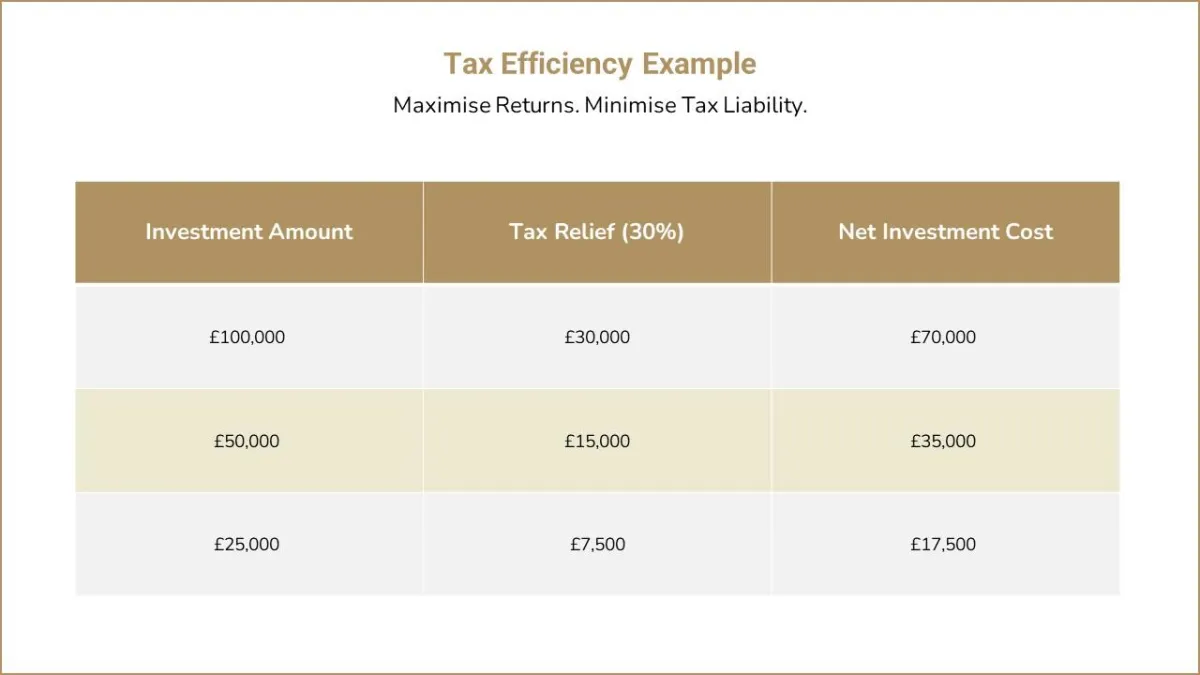

30% Tax Relief

Eligible investors receive up to 30% income tax relief, reducing liability while participating in potentially high-yield private equity.

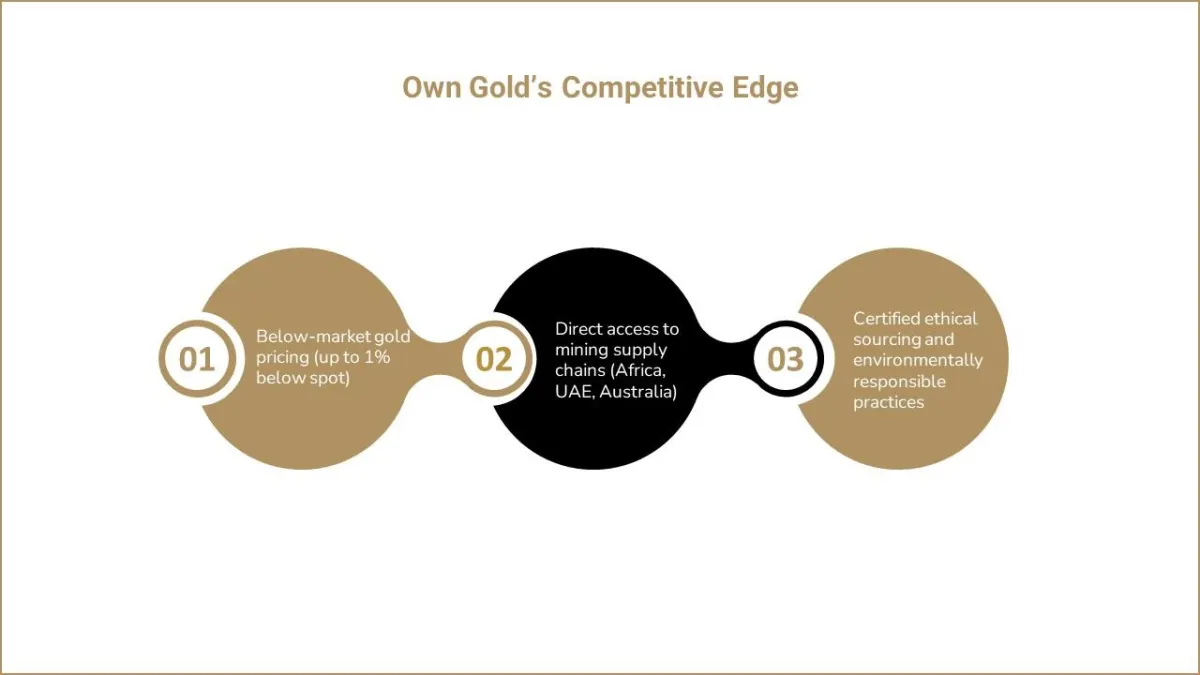

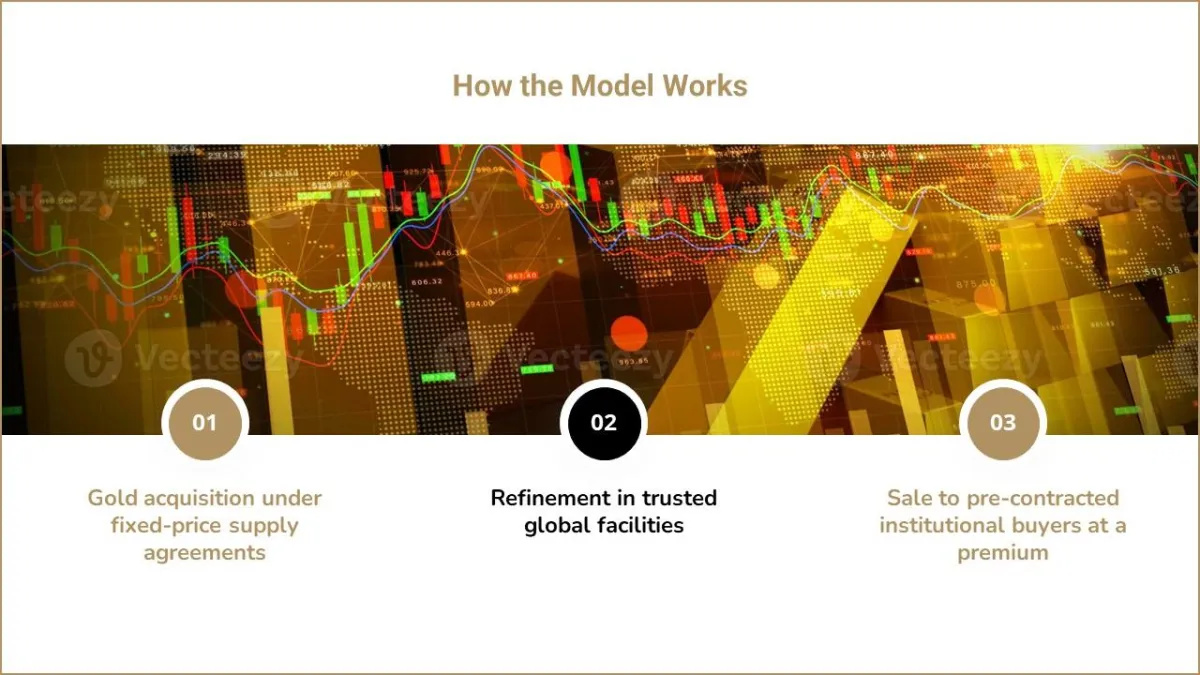

Secure Your Wealth with Gold Bonds

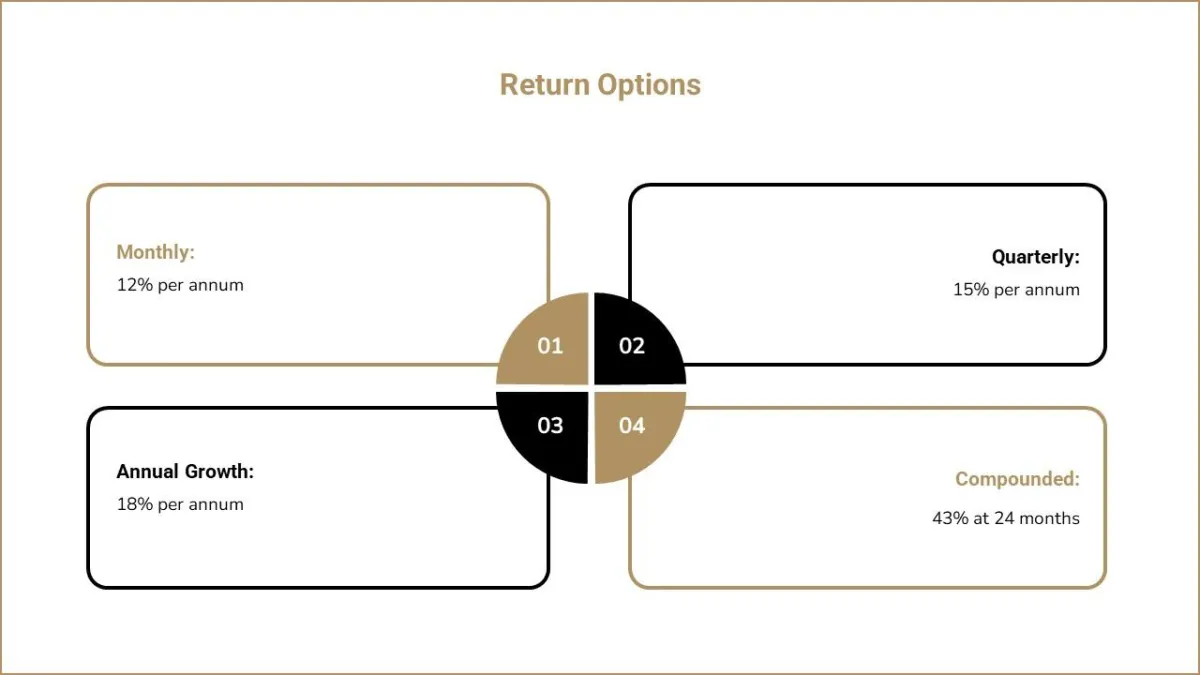

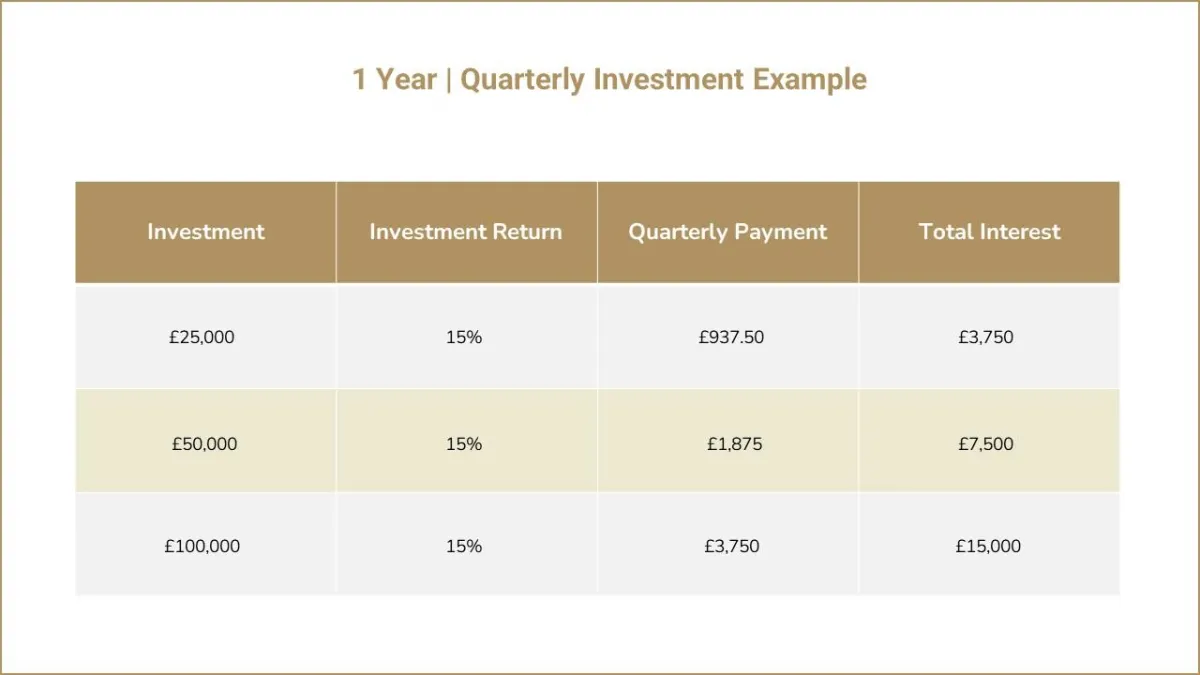

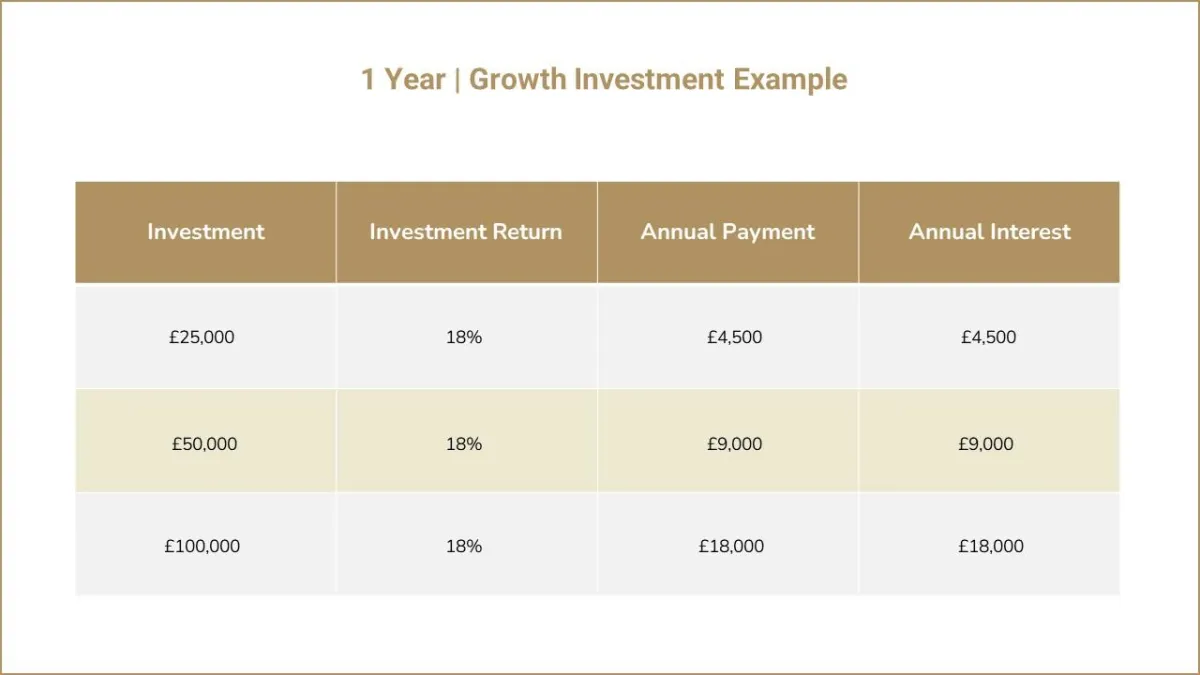

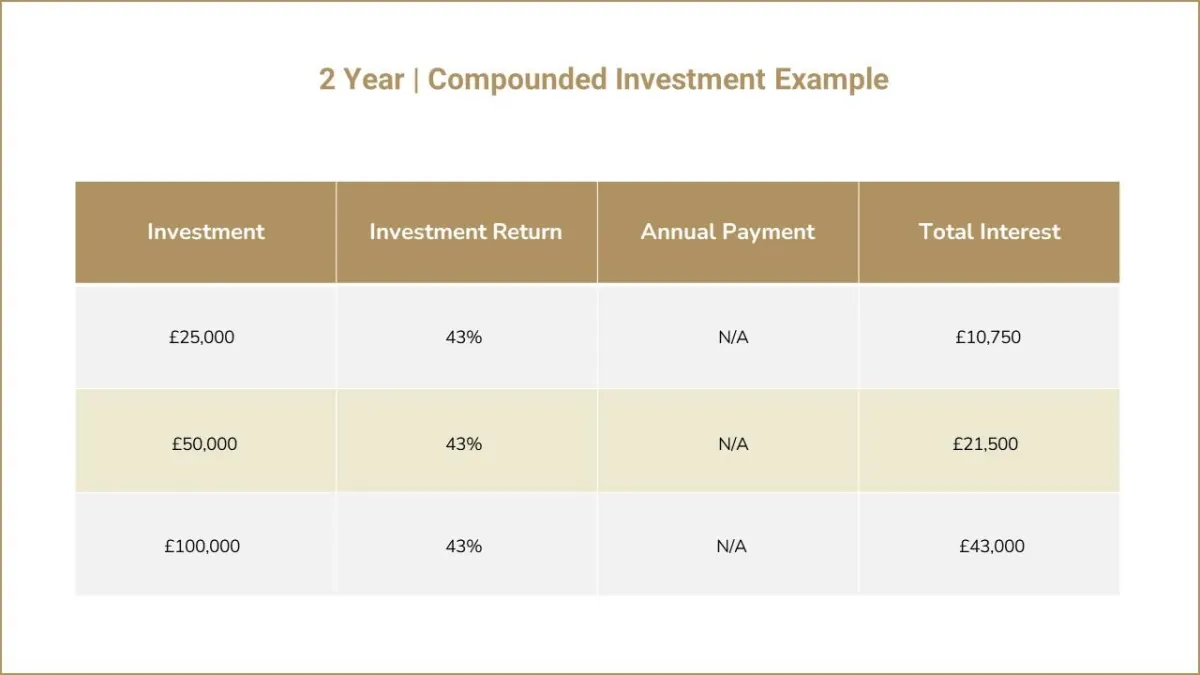

Gold bonds offer a secure and inflation-resistant path to wealth building. Our opportunities are structured for stability and growth, backed by physical assets and regulated frameworks. Investors benefit from a strong annual performance of 18% p.a., with compounded returns reaching up to 43% over 2 years. Perfect for those seeking high-yield, medium-term investment strategies with lower market correlation.

18% Annual Returns

Earn a consistent 18% return per annum on your gold-backed investment with structured security.

43% Compounded in 2 Years

Let your investment grow through compounding over two years, potentially achieving 43% total gains.

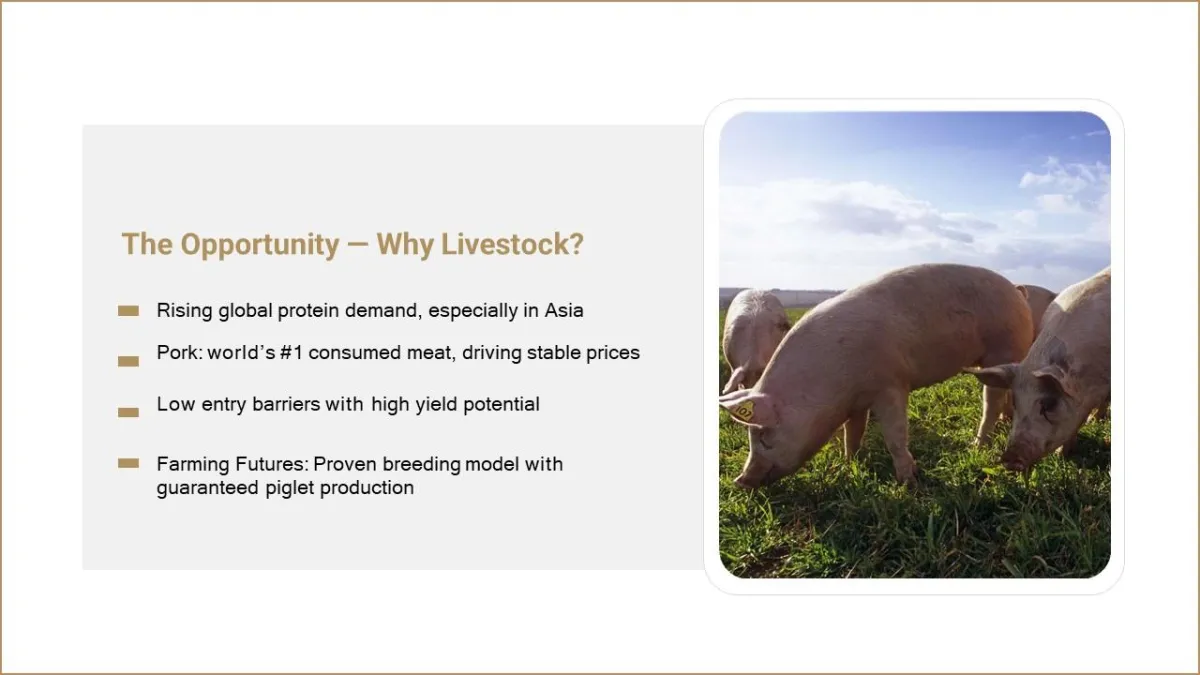

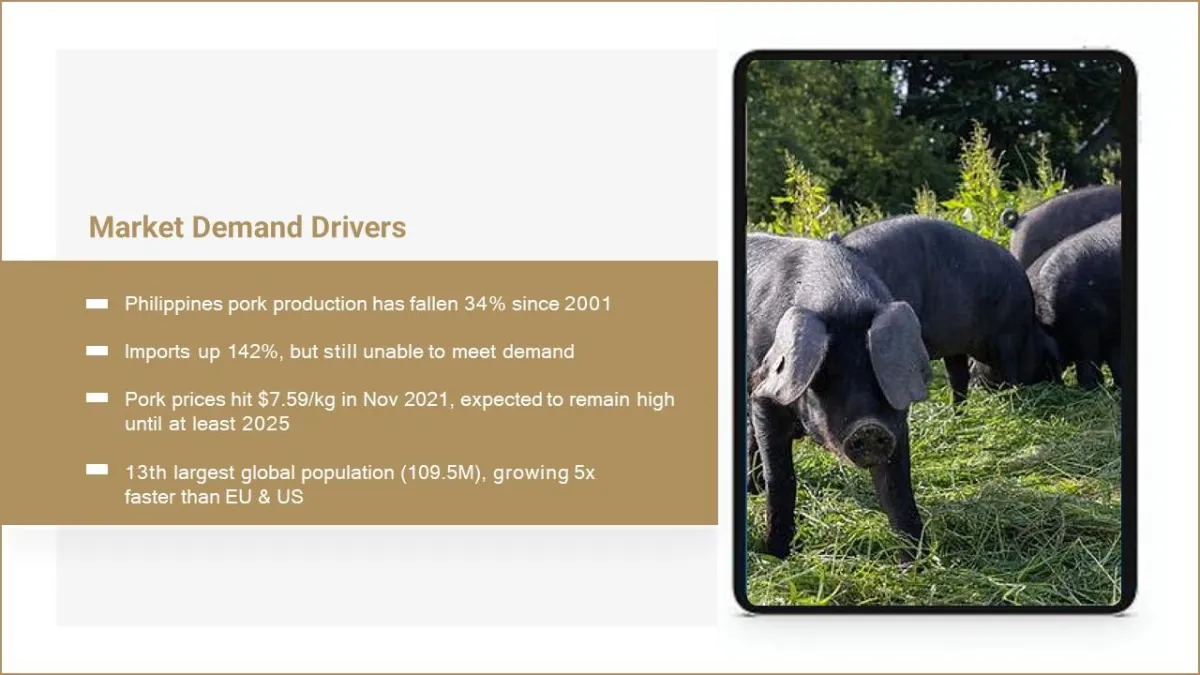

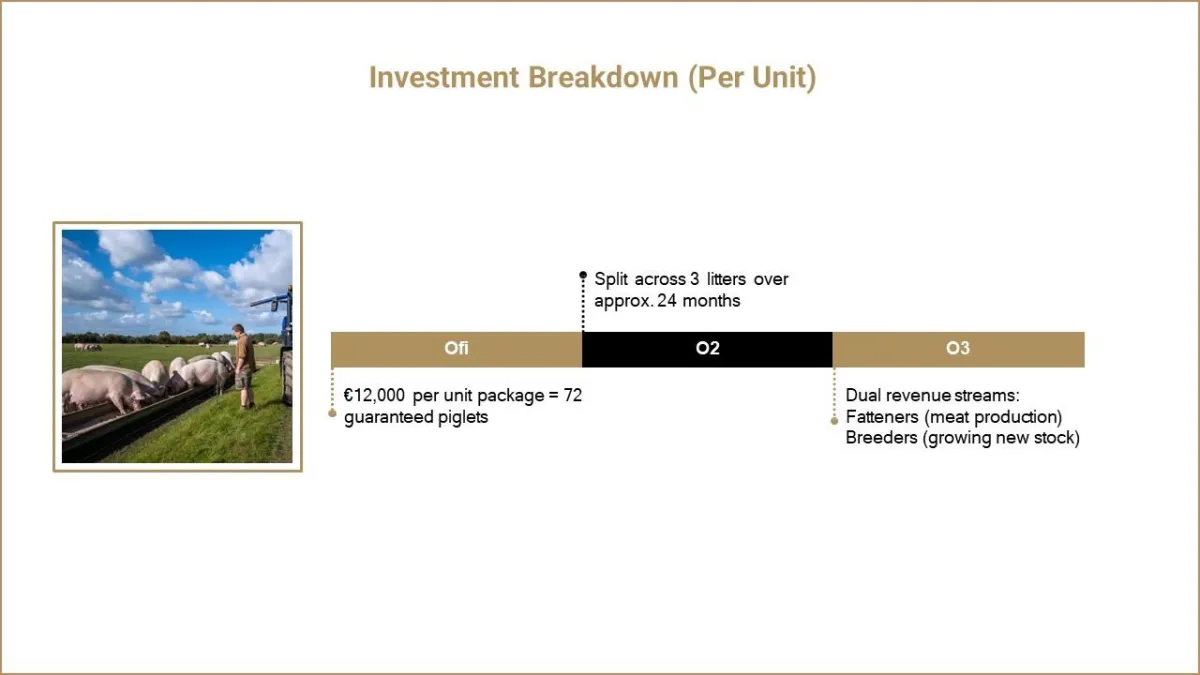

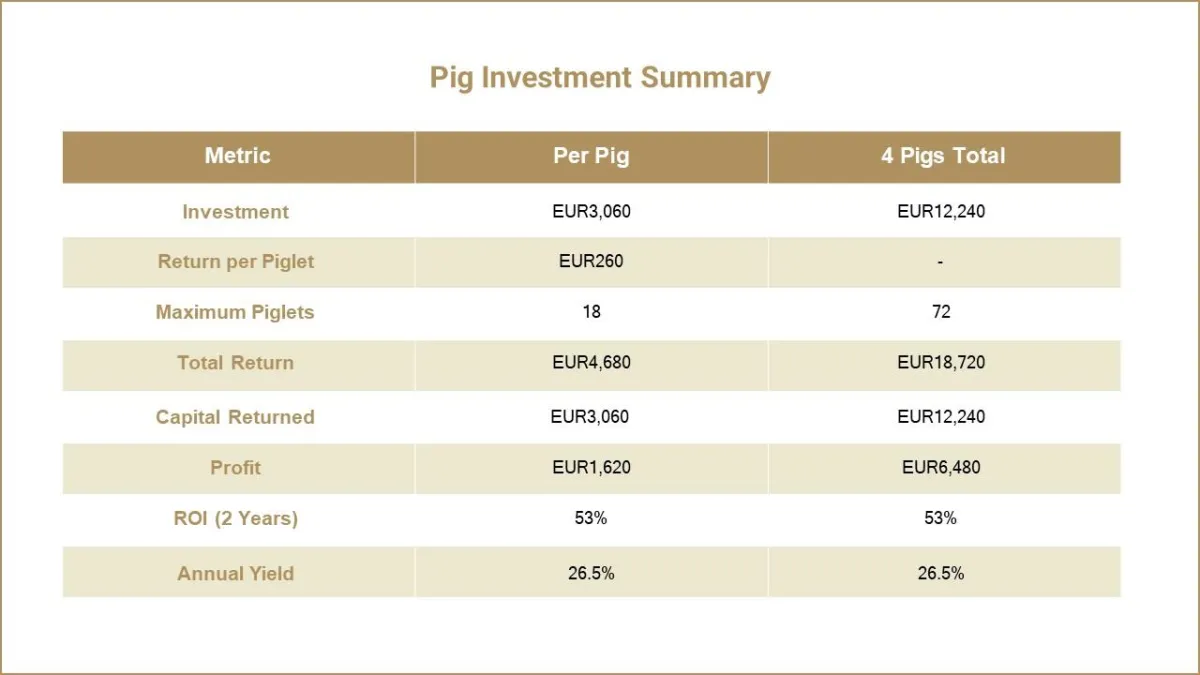

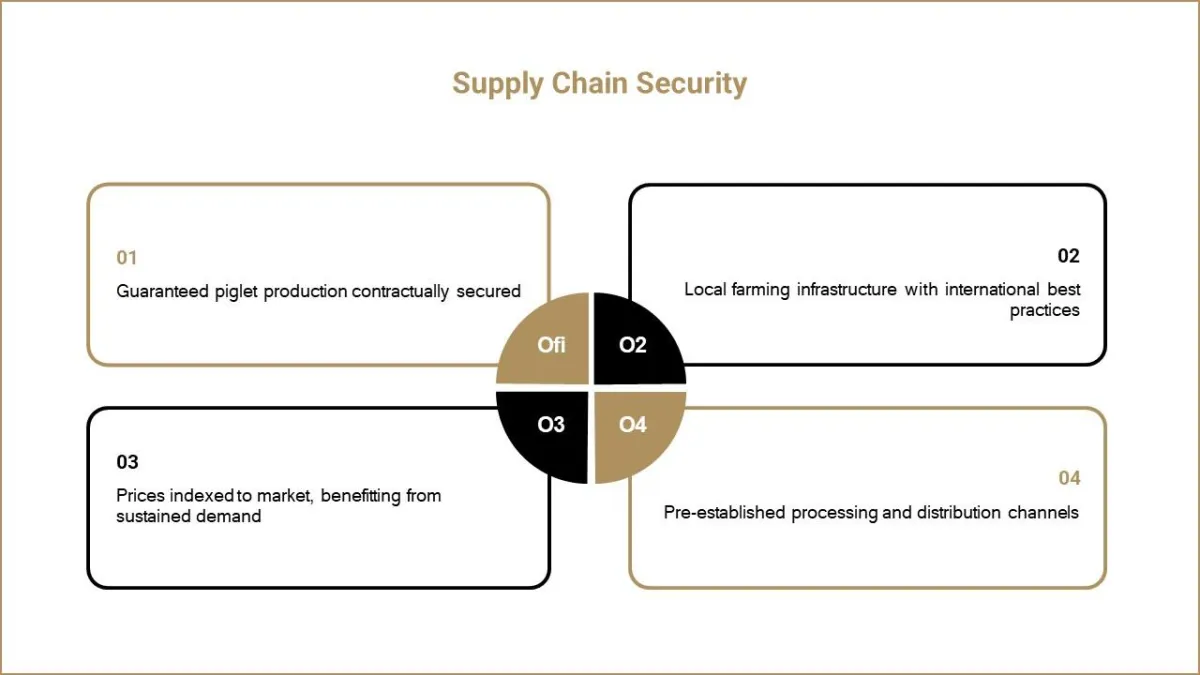

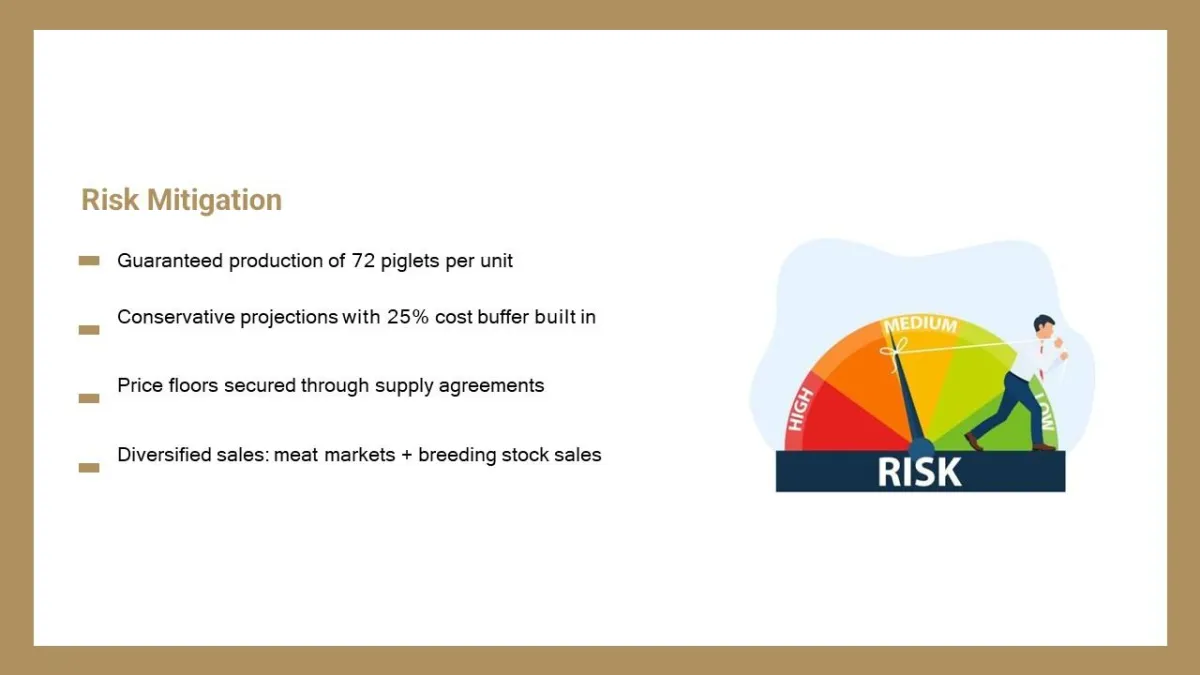

Ethical & Profitable Livestock Investments

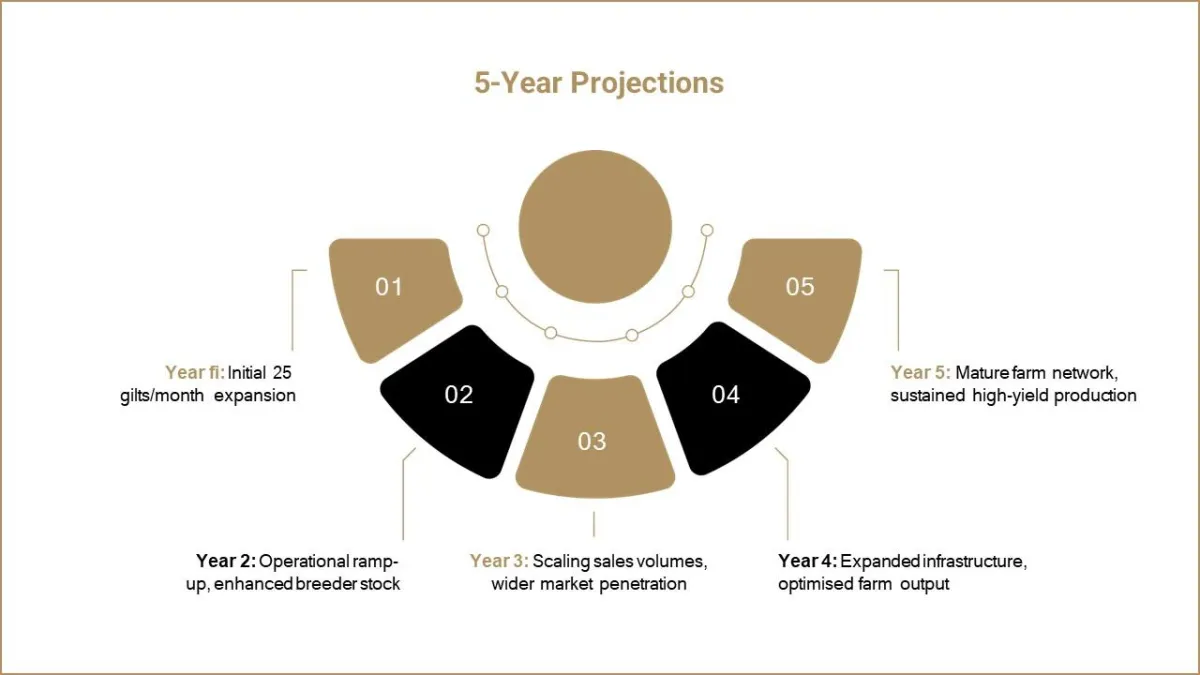

Livestock investment opens a path to participate in real-world assets with growing global demand. Through structured agreements with vetted agricultural providers, investors can gain from both income and capital appreciation. It’s a tangible, ethical investment that supports sustainable farming while delivering returns.

Tangible Agricultural Asset

Backed by real livestock, this investment diversifies portfolios into the essential global food production sector.

Ethically Sourced & Managed

Partnerships with regulated, humane producers ensure both animal welfare and investor transparency.